|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

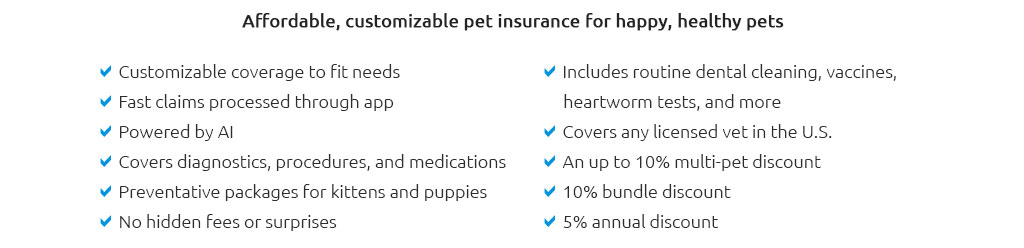

Exploring the Best Pet Health Insurance Plans for Informed DecisionsIn today's world, where pets have seamlessly woven themselves into the fabric of our families, ensuring their well-being is not just a choice but a responsibility. The rising costs of veterinary care have made pet health insurance an appealing option for many pet owners seeking to safeguard their furry companions. However, with a plethora of choices available, selecting the best plan can be a daunting task. This article delves into the intricacies of pet health insurance plans, offering insights into what to expect, thereby empowering you to make an informed decision. Firstly, it is essential to understand what pet health insurance entails. Unlike human health insurance, pet insurance primarily functions on a reimbursement basis, which means you pay the vet upfront and then submit a claim to the insurance provider. Policies can vary widely, covering anything from accidents and illnesses to routine check-ups and preventive care. When exploring pet insurance plans, one must consider the coverage limits, deductibles, and reimbursement levels, all of which can significantly influence the overall cost and value of the plan. Among the myriad of options available, Nationwide is a name that often stands out. As one of the largest and most reputable pet insurers in the market, they offer comprehensive plans that cover accidents, illnesses, and wellness care, making them a top contender for those seeking extensive coverage. Additionally, their plans are customizable, allowing pet owners to tailor the coverage to their specific needs. However, some may find their premiums slightly higher compared to other providers. Another noteworthy mention is Healthy Paws, renowned for their simplicity and efficiency. They offer a single, straightforward plan that covers accidents and illnesses, with no caps on payouts, which can be incredibly reassuring in the face of costly medical treatments. Their focus on ease of use and quick claim processing has garnered them a loyal customer base. Nevertheless, it's important to note that they do not cover routine or preventive care, which might be a drawback for some pet owners. Embrace Pet Insurance is also a popular choice, particularly for those interested in wellness coverage. They provide a comprehensive accident and illness plan, alongside an optional wellness rewards program that covers routine care. This flexibility allows pet owners to create a well-rounded plan that suits their budget and their pet's health needs. However, as with any insurance, the premiums can vary based on factors such as the pet’s breed, age, and location. For budget-conscious pet owners, Figo Pet Insurance offers competitive pricing without skimping on essential coverage. Known for their user-friendly app and excellent customer service, Figo provides plans that cover a wide range of conditions and treatments. Their plans also offer the unique advantage of covering alternative therapies, which can be a boon for pet owners exploring holistic treatment options. Nonetheless, like all insurance plans, it’s crucial to read the fine print to understand the exclusions and limitations. As you navigate through these options, it’s important to consider what matters most to you and your pet. Do you prefer comprehensive coverage that includes wellness care, or are you primarily concerned about catastrophic events? Understanding your priorities will guide you in choosing a plan that provides peace of mind without straining your finances. FAQs What factors should I consider when choosing a pet insurance plan? Consider factors such as coverage limits, deductibles, reimbursement levels, and whether the plan covers wellness and preventive care. Additionally, evaluate the insurer's reputation, customer service, and claim processing times. Is pet insurance worth the cost? Pet insurance can be worth the cost if you seek to mitigate unexpected veterinary expenses. It offers financial protection and peace of mind, particularly in emergencies or for chronic conditions. Do all pet insurance plans cover pre-existing conditions? Most pet insurance plans do not cover pre-existing conditions. It's essential to review the policy terms to understand what is considered a pre-existing condition and any applicable waiting periods. How does the reimbursement process work in pet insurance? Typically, you pay the veterinary bill upfront and submit a claim to your insurer. The insurer then reimburses you based on your plan’s reimbursement level, after accounting for any deductibles. Can I insure older pets? Yes, many insurers offer plans for older pets, although premiums may be higher, and coverage options might be more limited compared to younger pets. https://www.reddit.com/r/petinsurancereviews/comments/1c0bno9/best_pet_insurance_for_dogs_cats_according_to/

Pets Best is my top recommendation for similar reasons above. Additional, Pets Best has detailed dental coverage which can be an issue for many ... https://www.petinsurancereview.com/

See the best pet insurance providers - Embrace. 4.9. 18,009. $100 $1,000 annually - Healthy Paws. 4.9. 10,123. $250, $500 or $750 annually - Trupanion. 4.9. https://www.aspcapetinsurance.com/

One of the most extensive plans on the market ; Preventive Care, Yes, No ...

|